Car Road Tax Price Malaysia

Youll find prices specifications warranty details high-resolution photos expert and user reviews and so much more packaged in a user-friendly intuitive layout that is easy to read. 50-litre Ford Mustang has much higher road tax than 10-litre Perodua Axia.

How Much Do You Know About Malaysian Road Tax Ezauto My

Actual Road Tax payable RM37850.

. Do note that recently in Malaysias Budget 2022 the government has announced that there will be tax-free incentives for EV cars inclusive of road tax. Car variant Peninsular Malaysia Region Individual Owned. Mercedes-Benz GLA Road Tax Price List Calculation results are based on conditions.

The EQC is the EV version of the regular Mercedes-Benz GLCJust one variant is offered here the EQC 400 4Matic with an estimated price of RM 390k. Comparing car insurance quotes with us only takes 1 minute. Road Tax for Commercial Vehicles JPJ.

Calculate Your Road Tax. RENEW YOUR CAR INSURANCE ROAD TAX NOW. Above 75 kW to 10 kW.

Mercedes-Benz Malaysia has just previewed the 2022 Mercedes-Benz EQC 400 4Matic alongside the EQB 350 and EQS 450. One result of this lower road tax in East Malaysia is having bigger displacement variants of cars selling better in East Malaysia. Toyota Vios road tax price is RM 90-RM 90.

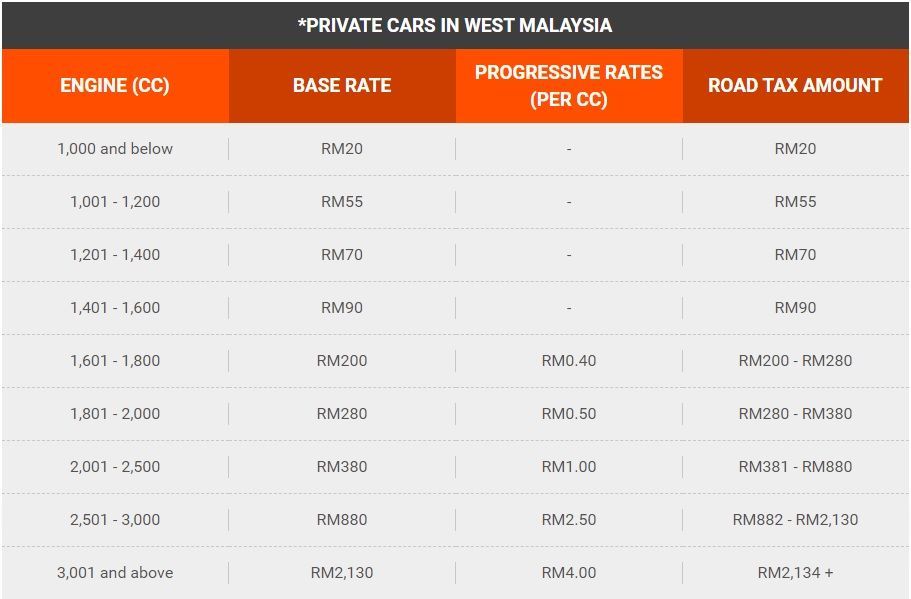

The tax can be as much as three times higher something to consider if you are planning on using a car loan calculator. 1799cc 1601cc x RM040 198 x RM040 RM7960 The 01cc. Road Tax for Public Transport.

Base bracket RM28000. Volkswagen Polo road tax price is RM 20-RM 90. Check the latest Toyota Vios road tax cost in Malaysia 2022 with the help of the Toyota Vios road tax calculator.

Road Tax in Malaysia. The vehicle use will also determine the road tax and it might also affect the result in the car insurance quotes. Total of progressive rate.

RM050 progressive rate x 200 RM100. We can see it has a base rate of RM200. Total road tax.

Renew your car insurance and road tax with us and get it delivered to you for FREE. So this puts your car into the 100kW 125kW bracket for the road tax. Otomy is the best way to buy and sell new used and reconditioned cars in Malaysia.

The road tax payable is RM37850. GET STARTED NOW. The bigger the engine displacement the higher the price of the road tax.

To calculate the progressive rate we take the 1799cc and minus it with the 1601cc in the table. The road tax on electric motorcycles in Malaysia is fixed at RM 2 for vehicles having an output rating of 75 kW. Engine cc Base Rate.

Road Tax for Commercial Vehicles. RM274 base rate Remaining 10kW. We have helped 500000 people with their insurance needs.

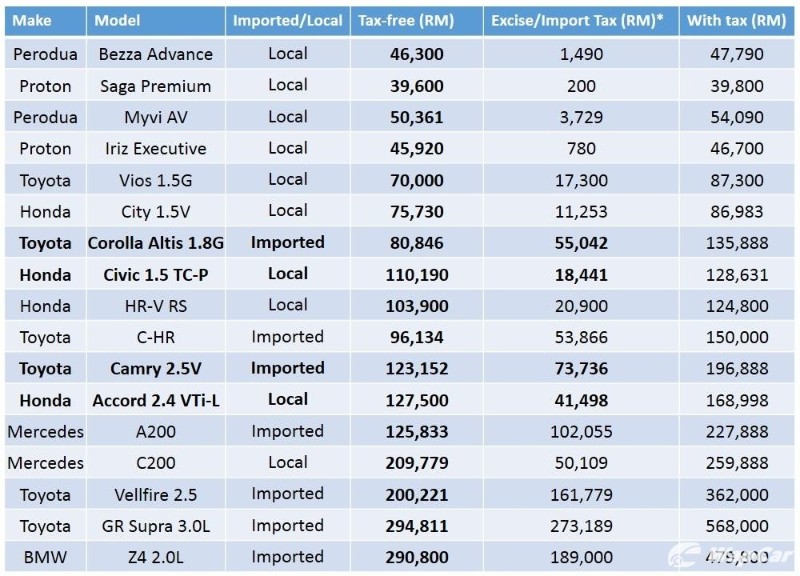

Take for example the Isuzu D-Max The 30-litre version is more popular in East Malaysia compared to West Malaysia. If you use a company vehicle the odds are you will pay a higher road tax in Peninsular Malaysia. In Malaysia the road tax for combustion engine cars is calculated based on the engine displacement.

Use otomy to reach over 2000000 car buyers on Malaysias 1 automotive network. Looking at the Road Tax Price for Cars in West Malaysia table Proton X70 that we are talking about falls between 1601 and 1800 cc. Check the latest Volkswagen Polo road tax cost in Malaysia 2022 with the help of the Volkswagen Polo road tax calculator.

SUVMPVPick-up in East Malaysia road tax. 2022 Honda HR-V price in Malaysia Variant Price 15 S RM 114800 15 E RM 129800 15 V RM 134800 RS eHEV. Toyota Vios Road Tax Price List.

Above 75 kW the rate is calculated as per the following. List the price range according to these different factors and link externally to the JPJ website. But then again theres a market for their cheaper counterparts too and thats a question well try our best to answer in this piece.

Mercedes-Benz GLA road tax price is RM 70-RM 376. For Company Registered vehicles except for MPV SUV Pick-up refer to Company Registration Table for road tax amount payable. Progressive 1997 1800 x 050 RM9850.

Or find your next car amongst the quality listings at otomy. Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak is in this link. Last year in June the government announced a decision to place sales tax SST exemption for cars cut sales tax on CKD cars while offering 50 sales tax discount for CBU models as part of the Penjana stimulus packageIt was supposed to last until 31-December 2020 but in a twist that brought mixed reactions in the local automotive industry the Ministry of Finance extended the.

Toyota Vios road tax price is RM 90-RM 90. Using the same Honda Accord 1997cc as example the road.

Topgear Ev Talk Why The New Tesla Model S S Road Tax Would Cost Rm17k In Malaysia

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Road Tax Paid To Jpj Don T Go To Road Maintenance So What Are We Paying For Wapcar

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

0 Response to "Car Road Tax Price Malaysia"

Post a Comment